How to Apply for Tax-Exempt Status on Lifting.com

Setting up your tax-exempt account is now fast and fully automated. Follow these steps to ensure a seamless, tax-free checkout experience:

-

Create or Log Into Your Account

Go to our online store and set up your account: Create Account. If you already have an account, just log in.

-

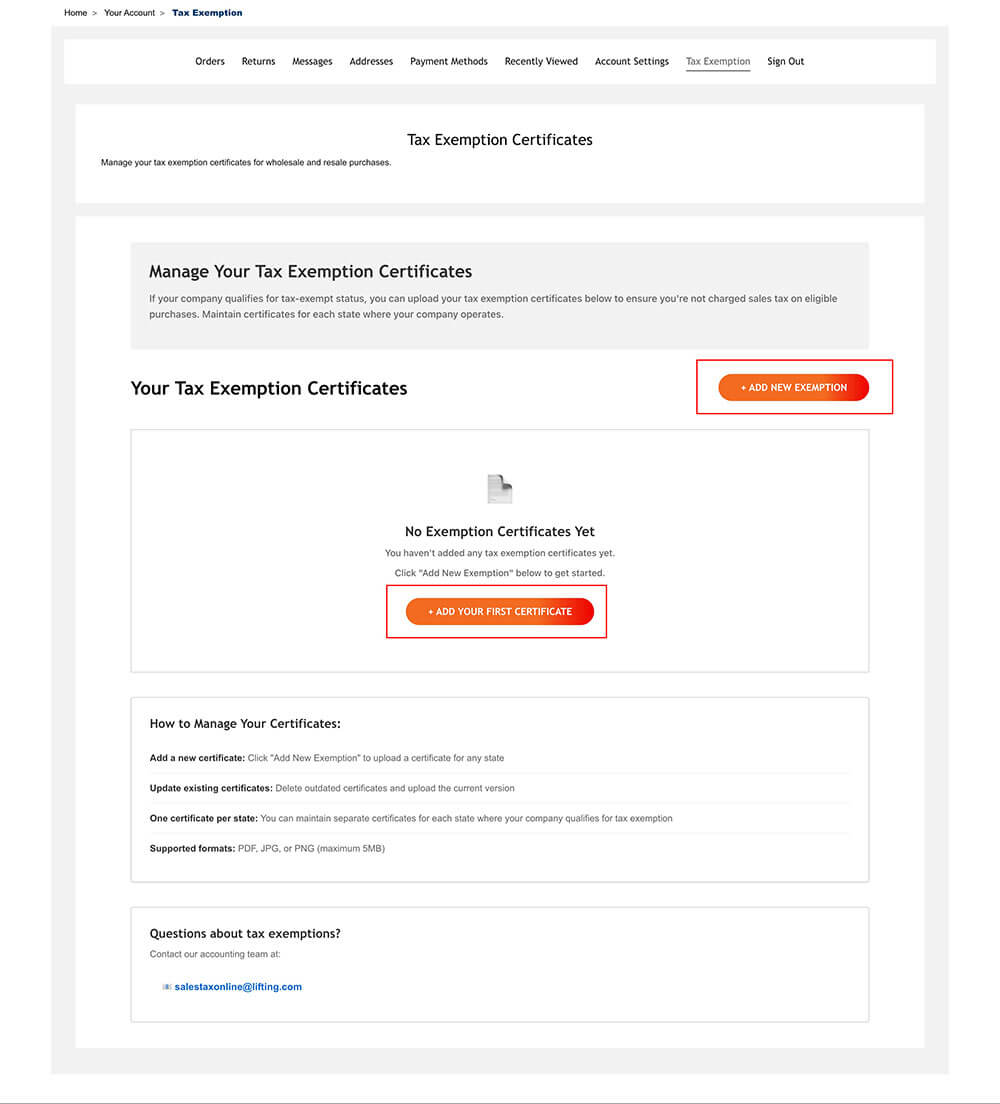

Navigate to the Tax Exemption Tab

In your account admin area, click on the Tax Exemption tab.

-

Add Your Exemption Certificate

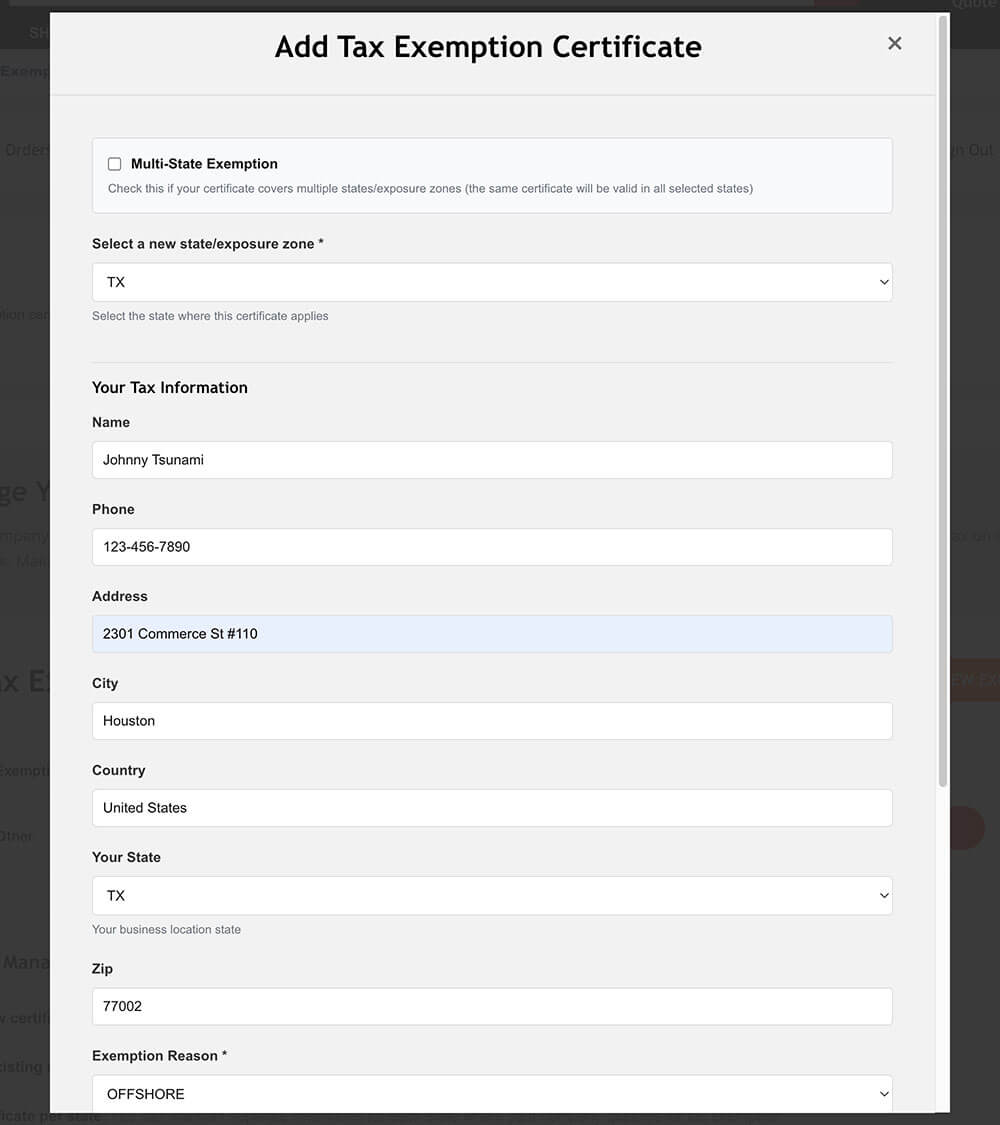

- Click the + Add New Exemption button.

- Upload a valid exemption certificate or reseller permit for each applicable state.

- You may upload multiple certificates as needed per state.

-

Instant Approval & Checkout

- Your exemption will be approved instantly, so you can check out tax-free right away.

- Our team will later review your certificate(s) and will contact you only if there are any issues.

- You will keep your status unless your paperwork has issues or expires.

-

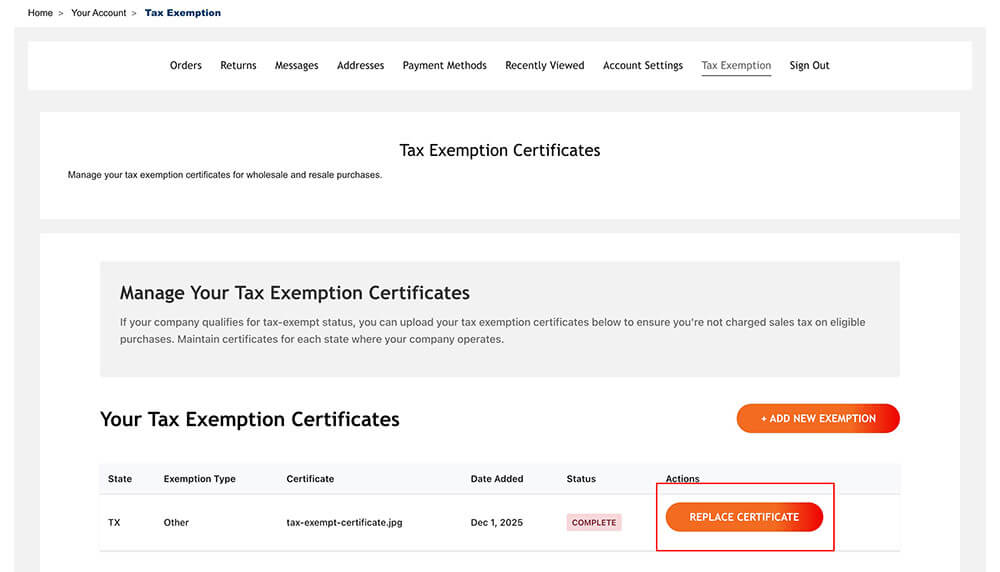

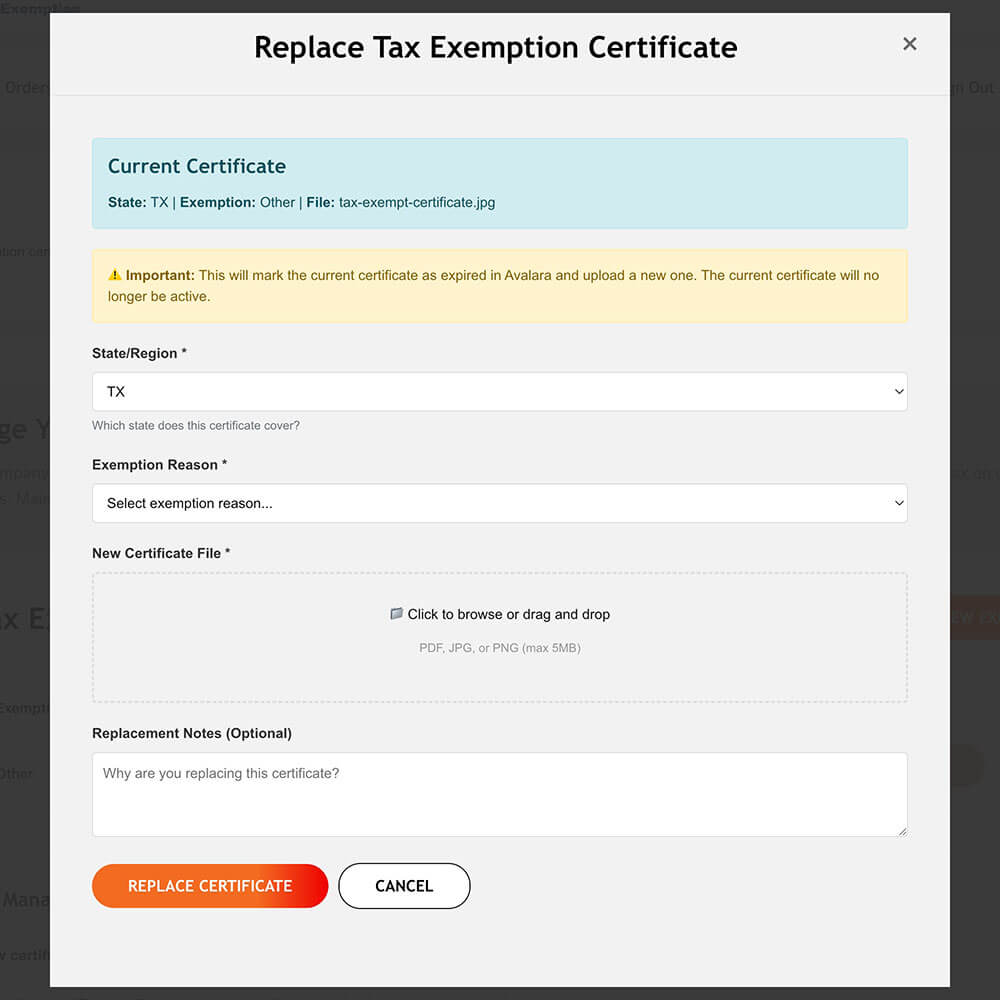

Manage or Update Certificates

To update, replace, or add additional certificates for different states, return to the Tax Exemption tab at any time.

Export Orders & Sales Tax Refund Policy

Export customers must provide a bill of lading or other proof of export showing the goods have left the United States before a sales tax refund can be issued. This requirement applies to all export orders, unless the customer holds a valid sales tax exemption in the state where the freight forwarder is located (e.g., Florida). Export documentation may be emailed to salestaxonline@lifting.com to request a refund.

Important Notes:

- Always log into your approved account for the exemption to apply at checkout.

- If you have urgent questions or run into issues uploading documents, email us at: salestaxonline@lifting.com.